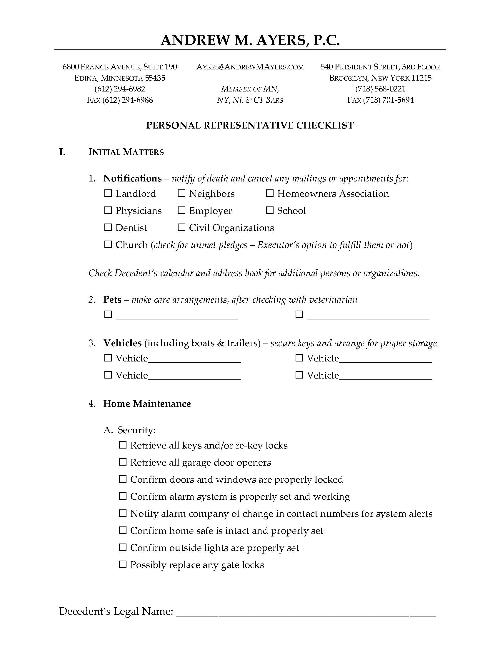

.jpg) As you create your estate plan, one of the main decisions you will confront is who will be your personal representative (sometimes called an Executor) under your will. When they are appointed, their job is to manage your estate after you are gone. If you have children under 18, they are charged with making sure they are connected with the guardian you have chosen and that the trustee of any trust receives their inheritance to manage on their behalf. When you have specific gifts (to charities, other family members, etc.), their job becomes one of making sure that the right people get the right items under your will.

As you create your estate plan, one of the main decisions you will confront is who will be your personal representative (sometimes called an Executor) under your will. When they are appointed, their job is to manage your estate after you are gone. If you have children under 18, they are charged with making sure they are connected with the guardian you have chosen and that the trustee of any trust receives their inheritance to manage on their behalf. When you have specific gifts (to charities, other family members, etc.), their job becomes one of making sure that the right people get the right items under your will.

Even if they follow your will precisely, your family members may not be happy with the way you have distributed your estate. In that case, the personal representative ends up in a tough position, where they may find themselves subject to attempts to remove them for their role. Lawyers can be involved, a court may have to make a ruling on the requests, and a lot of contention and animosity can be found amongst your family members when someone makes a request to remove your personal representative.

So let's look at the reasons for removing a personal representative, the legal grounds for removal, and the steps involved in the process.

Reasons for Removing a Personal Representative

Removing a personal representative is not a decision to be taken lightly. Typically, it is considered when the representative fails to fulfill their duties or acts in a manner detrimental to the estate. Common reasons for removal include:

-

Embezzlement or Fraud: If the personal representative is found to be stealing from the estate or committing fraud, immediate action must be taken to protect the estate's assets. Even if they are not stealing from the estate, this is a common claim in probate litigations as a way to justify a court's involvement.

-

Neglect of Duties: A personal representative may be removed if they neglect their responsibilities, such as failing to file necessary documents, not paying estate debts, or delaying the distribution of assets.

-

Conflict of Interest: Situations where the personal representative's interests conflict with those of the estate or its beneficiaries can warrant removal.

-

Incapacity: Physical or mental incapacity that prevents the personal representative from performing their duties effectively is another valid reason for removal.

-

Misconduct: Any form of misconduct, including unethical behavior or mismanagement of the estate, can justify the removal of a personal representative.

There can be other reasons that may be raised, but these are the most common ones that I've encountered in my practice.

Legal Grounds for Removal

The legal grounds for removing a personal representative vary by jurisdiction, but generally include some of the following:

-

Breach of Fiduciary Duty: Personal representatives have a fiduciary duty to act in the best interests of the estate and its beneficiaries. Breaching this duty through actions such as self-dealing, failing to keep accurate records, or mishandling estate assets can lead to removal.

-

Inability to Perform Duties: Demonstrable inability to manage the estate, whether due to neglect, incompetence, or other reasons, can be grounds for removal.

-

Failure to Comply with Court Orders: Personal representatives who disregard court orders or fail to follow legal procedures risk being removed.

-

Fraudulent Conduct: Engaging in fraud or other illegal activities directly impacting the estate can result in removal.

It's important for you to understand the specific legal grounds in the state where the estate is located. While you can find lots of good information on the internet, it's important to speak with a local attorney who understands the requirements in that state.

Steps to Remove a Personal Representative

Removing a personal representative involves several steps, which typically include:

-

Identify Grounds for Removal: Clearly document the reasons for seeking removal, providing evidence of any misconduct, neglect, or conflict of interest.

-

Consult an Attorney: Seek legal advice to understand the specific procedures and requirements in your jurisdiction. An attorney can help assess the strength of your case and guide you through the process.

-

File a Petition: Submit a petition for removal to the probate court. This document should detail the grounds for removal and include any supporting evidence.

-

Notify the Personal Representative: The personal representative must be formally notified of the petition. They have the right to respond and present their defense.

-

Probate Court Hearing: The court will schedule a hearing to review the petition and any responses. Both parties can present evidence and arguments. You'll need to check with the court to determine if the hearing is in person or virtually (many are still virtual these days).

-

Court Decision: After reviewing the evidence and hearing both sides, the court will decide whether to remove the personal representative. If removed, the court may appoint a successor, either from a list of alternates provided in the will or based on state laws governing estate administration.

These steps may be a little different depending on what state the estate is in, but it's a basic list of steps that you should consider if you are looking to remove a personal representative.

Potential Challenges and Considerations

Removing a personal representative can be a complex and contentious process. Here are some challenges and considerations to keep in mind:

-

Burden of Proof: The burden of proof lies with the petitioner. Sufficient evidence must be provided to convince the court of the need for removal.

-

Family Dynamics: Removal petitions can strain family relationships, especially if the personal representative is a close relative. Consider mediation or alternative dispute resolution methods before pursuing legal action.

-

Legal Costs: The process of removing a personal representative can be costly, involving attorney fees and court costs. Weigh the potential benefits against the financial implications.

-

Time: The legal process can be lengthy, potentially delaying the administration and distribution of the estate. Consider the impact on beneficiaries and the overall timeline of estate settlement.

Removing a personal representative is a significant legal action that requires careful consideration and substantial evidence. By understanding the valid reasons for removal, the legal grounds, and the procedural steps involved, you can navigate this challenging process more effectively. Always consult with legal professionals to ensure that your actions are in the best interests of the estate and its beneficiaries.

Need Help Choosing Your Personal Representative?

Choosing a Personal Representative (or Executor) is an important part of your estate plan, and if you need help with the process, let's schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you to work with an estate planning attorney.