One of the side effects of the new work-from-home normal that many people find themselves in is that they are able to explore their passions. With less time stuck in the car or on a train to the office, you have more time to delve into projects that interest you personally. Inevitably, you may begin to consider whether that passion can turn into a profitable stream of income for your household. Depending on how you approach it, you may even be able to turn it into a profitable business.

One of the side effects of the new work-from-home normal that many people find themselves in is that they are able to explore their passions. With less time stuck in the car or on a train to the office, you have more time to delve into projects that interest you personally. Inevitably, you may begin to consider whether that passion can turn into a profitable stream of income for your household. Depending on how you approach it, you may even be able to turn it into a profitable business.

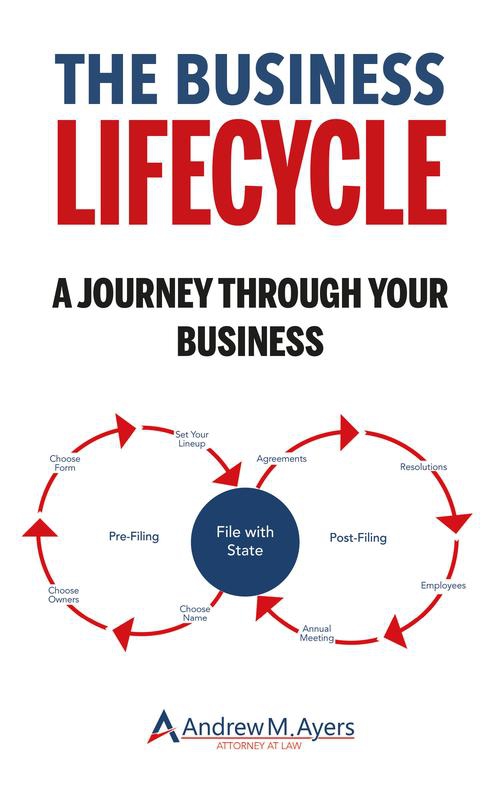

If that passion continues to grow, the next natural consideration for you is whether it's time to formally incorporate your business. Although you may think this process takes a long time, you'd be surprised to find that many people very quickly make a decision to set up an LLC. The process itself depends on where you are located, but it is generally a quick process to implement. Some basic steps to get you started:

- Incorporate with Your State

- Creating your Business Documents

- Get an EIN Number from the IRS

- Open a Business Bank Account

As you get the process started, I always recommend that you speak to a business lawyer. We'll be able to help guide you through the process and highlight some of the benefits of an LLC for you as a business form.

An LLC For Liability Protection

One of the primary reasons that people form an LLC is to protect their personal assets from liability. If they are starting a business, they want their business liability to be limited to the assets in the business. When you own a rental property, an LLC can be used in a similar fashion. By creating an LLC for each property, you limit the liability for that property to the value of that property alone. If you are sued by a tenant, one of their guests, someone else on the property (even someone who may be trespassing and gets injured), their recovery in a lawsuit would be limited to the value of the property in the LLC.

When you don't use an LLC to own a property, if you are sued as the owner/landlord, your personal assets could be on the line to pay off a judgment against the property. That could include taking money from your bank accounts or even garnishing your paycheck from your employer.

As a further bonus, the LLC can also be used to protect your privacy. If you don't name your LLC "The John Smith Rental Property LLC", then the tenants won't know who the real owners are. You can have some fun naming the LLC and then, if the property does get involved in a lawsuit, it's the LLC, not you, who gets to deal with the lawsuit and the lawyer can be the person who has to deal with it because companies can't represent themselves in court. And if you really want to stay anonymous, when you set up the LLC, you can use a registered agent with the state so that no one truly knows who owns the LLC.

Tax Benefits of the LLC

When you create an LLC, it's common that you're doing it for the tax advantages that come with it. This part of the equation is where I always encourage you to speak to your accountant and financial advisor to be sure that the LLC is the right vehicle for your investments. Assuming it is, the LLC provides for a different tax rate than your normal income and is taxed at a different rate than a traditional corporation. Utilizing the LLC, you can use the rental income that it receives to reinvest it into the property to create even more value - you can essentially have an LLC that pays for itself and you don't have to worry about declaring all that rental income on your personal taxes each year.

Create an Operating Agreement for Your LLC

Like an estate plan, an operating agreement should be tailored to each LLC. While you can generalize a lot of terms about an LLC, each LLC is different and requires customization in its documents. Some common issues to address are

- Purpose of the LLC

- Day-to-Day Operations

- Who are the members

- Duties of the members

- Management of the LLC

- Contributions of the members

- Process for a Member leaving the LLC

- What happens if a member gets divorced

- What happens if a member dies

- Liabilities of the members

- A dissolution process to close the LLC

There are many resources available to learn more about an LLC operating agreement. The library is full of books for business owners. Your state’s Secretary of State likely has a section of their website devoted to LLCs and their operating agreements. And of course, for a small fee, there are any number of websites that will mail merge your information into an outdated form. But the best option is to sit down with a lawyer and discuss your company and what its needs are.

Next Steps

If you're ready to turn that side hustle or passion project into a business and want to discuss creating an LLC, let's set up a Legal Strategy Session to discuss the next steps and options for you and your business.