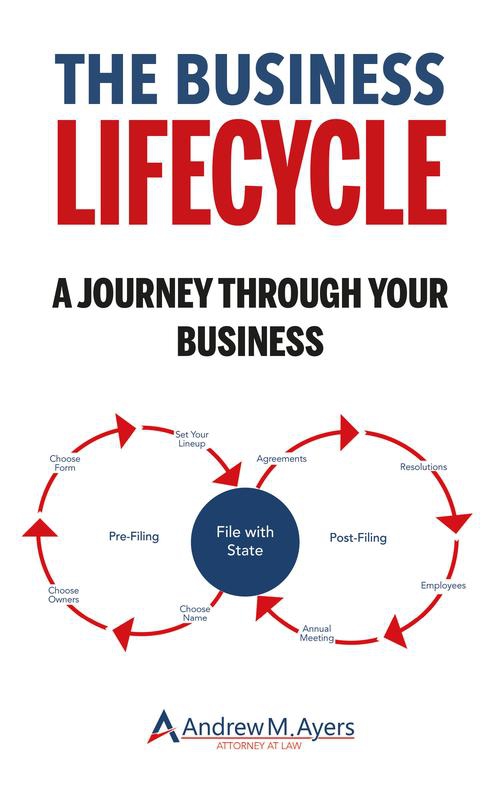

There are lots of intricacies to running your business that you don't see featured in television shows. They often include the basic documents that are needed to set up your company (like an operating agreement for your single-member LLC) and corporate filings with the state. These "boring" parts of our business are more than just checking boxes, they are essential for ensuring your compliance with your LLC's legal obligations.

There are lots of intricacies to running your business that you don't see featured in television shows. They often include the basic documents that are needed to set up your company (like an operating agreement for your single-member LLC) and corporate filings with the state. These "boring" parts of our business are more than just checking boxes, they are essential for ensuring your compliance with your LLC's legal obligations.

One often-overlooked aspect of running a Minnesota LLC is the need for an annual meeting, even if it's not explicitly required by state law. While Minnesota does not legally mandate annual meetings for LLCs, holding them offers multiple benefits, especially for multi-member LLCs, by keeping members informed, maintaining documentation for potential audits, and promoting transparent decision-making.

It's one of those little business tactics that you can adapt from others and that can add real value to your business.

What is an Annual Meeting, and Why is it Important?

An annual meeting is a formal gathering of your LLC members where you discuss the past year’s progress, financials, and future business plans. For many organizations, these meetings provide an essential time for business owners to review what’s working and what isn’t, strategize on future goals, and vote on key issues. Although an annual meeting for LLCs in Minnesota is not strictly required by law, it is still recommended, particularly for LLCs with multiple members, as a best practice.

For your Minnesota LLC, annual meetings allow your members to clarify roles, reflect on the business’s direction, and maintain a record of decisions made. Annual meetings also support transparent communication between LLC members, helping avoid conflicts and confusion. While it may be tempting for a single-member LLC to forgo an annual meeting, doing so could lead to overlooked compliance practices that can become problematic in the event of an audit or legal dispute.

Ensuring Compliance and Protecting Limited Liability

One of the main benefits of forming your LLC is the limited liability protection it offers. This protection ensures that your personal assets are separate from the business’s liabilities. However, in certain situations, a court might decide to "pierce the corporate veil," thereby holding LLC members personally liable for business debts. Having proper documentation of annual meetings helps safeguard this liability protection.

Annual meetings help to establish and preserve this separation by demonstrating that the LLC operates as a distinct business entity. By recording important business decisions made at annual meetings, LLC owners can present evidence of their adherence to corporate governance. Such documentation could prove crucial in an audit or legal proceeding, as it helps reinforce the legal distinction between your personal finances and the business.

Documenting Key Decisions and Actions

Annual meetings provide a structured opportunity to document essential decisions about business operations. For instance, members can vote on any major changes such as entering into new markets, securing loans, changing the ownership structure, or amending the operating agreement. Keeping records of these decisions ensures a clear historical account that members can refer to in the future.

This documentation can be helpful if the LLC undergoes changes in membership or ownership, as it provides a clear record of past decisions and policies that new members should be aware of. It also ensures that any major moves are made with the collective agreement and knowledge of all members, which can prevent future disputes.

Enhancing Transparency and Accountability Among Members

For multi-member LLCs, an annual meeting promotes transparency and accountability. It provides a setting for open discussion of financial reports, performance evaluations, and future business goals. Each member has the chance to voice opinions on strategic directions, discuss any concerns, and align with other members on the company’s direction. Regular, documented meetings also help each member understand their role and responsibilities more clearly, reducing misunderstandings.

Annual meetings can be especially useful for ensuring that all members are fully informed about the LLC’s financial health. Financial transparency is critical for maintaining trust among members, especially in cases where profits are reinvested or distributions are delayed. An annual meeting allows members to review the LLC’s financial statements, evaluate profitability, and discuss how funds should be allocated in the coming year.

Planning for Growth and Future Goals

One of the primary benefits of annual meetings is setting goals for the coming year. This is the ideal time to analyze what the business achieved over the last year, what challenges were faced, and how those obstacles were overcome. Members can discuss key performance indicators (KPIs), set new targets, and lay out actionable strategies for growth.

Annual meetings provide the structure for LLCs to be proactive about the future rather than reactive to day-to-day challenges. By regularly setting and reviewing goals, LLCs can establish a forward-thinking approach that helps them adapt to changes in the market, address weaknesses, and capitalize on opportunities. For single-member LLCs, holding an annual meeting also provides you with a formal checkpoint to review progress and focus on long-term planning, ensuring the business remains on a growth trajectory.

Simplifying Tax Filings and Financial Reviews

Annual meetings provide an opportunity to conduct a comprehensive review of financial records, which can be useful when preparing annual taxes. Members can discuss tax strategies, review deductions, and ensure that all tax documentation is in order. By formalizing this review in an annual meeting, LLCs reduce the risk of errors in tax filings and can make informed financial decisions for the following year.

Additionally, annual meetings can make it easier for accountants and tax preparers to understand the LLC’s financial situation. Minutes from these meetings serve as a valuable record when calculating taxes owed, providing documentation of any significant financial decisions made throughout the year.

Reducing the Risk of Internal Conflicts and Legal Disputes

Finally, annual meetings can help prevent conflicts among members by fostering regular communication and reducing misunderstandings. Business decisions are often more complicated in multi-member LLCs, as different members might have different visions or ideas for the company. Documented meetings provide a paper trail that can protect members in case of internal disputes or misunderstandings. By having a formal process in place, members can refer back to meeting minutes to clarify previous decisions and ensure they’re on the same page moving forward.

The minutes from annual meetings can serve as a critical piece of evidence if a disagreement arises, especially when they document all members’ consent to a decision. Having a record of these discussions not only resolves internal disputes but also adds a layer of protection in case of external scrutiny, as it demonstrates that the LLC has well-defined decision-making protocols.

Do I Need a Business Attorney?

If you've never had an annual meeting for your LLC, or if you're just getting started and want to make sure your business is off to the right start, let's schedule a Legal Strategy Session online or by calling my Edina, Minnesota office at (612) 294-6982 or my New York City office at (646) 847-3560. My office will be happy to find a convenient time for us to have a phone call to review the best options and next steps for you and your business.